A Registered Retirement Savings Plan (RRSP) is a savings and investment option designed for both employees and self-employed individuals to plan for their retirement. RRSP contributions offer significant tax benefits, allowing contributors to save money during their working years while postponing tax payments until retirement saving when their marginal tax rate is often lower compared to their working years. By utilizing an RRSP, individuals can optimize their retirement savings and minimize their tax obligations.

Any income you earn within the RRSP is exempt from tax. You only have to pay tax when you withdraw funds from the plan. This is why many Canadian taxpayers commonly use an RRSP to help them save for retirement, with the expectation that they will likely be in a lower tax bracket by the time they retire. So future withdrawals will be taxed at a lower rate than today.

Setting up an RRSP

You can easily set up an RRSP through a financial institution. They will advise you on the types of RRSP and the investments that suit your investment needs.

You may also set up a spousal or common-law partner RRSP. This type of plan can help ensure that retirement income is split evenly between both of you. The benefit is most significant if a higher-income spouse or common-law partner contributes to an RRSP for a lower-income spouse or common-law partner. The contributor receives the short term benefit of the tax deduction for the contributions, and the annuitant, who is likely to be in a lower tax bracket during retirement, receives the income and reports it on their Income tax and Benefits Return

Contributing to an RRSP

Deductible RRSP contributions for the current year can be made at any time during the year within the first 60 days of the following year. For example, the RRSP deadline for 2021 is March 1st, 2022. However, your contribution should be made as early as possible in order to maximize the tax deferrals offered by an RRSP.

Keep in mind that the RRSP has an age limit. You are eligible to contribute until December 31st of the year you turn 71 when as long as you have the available RRSP deduction limit room. Likewise, you can contribute to your spouse’s or common-law partner’s RRSP until December 31st of the year when they turn 71 years of age.

Generally, you are allowed to contribute up to 18% of your previous year’s earned income, to a maximum set each year by the Income Tax Act and Regulations (2021 – $27,830; 2022 – $29,210) plus any unused contributing room carried forward from prior years, minus the previous year’s pension adjustment (PA) which is a measure of the benefits that accrued to you as member of an employer-sponsored pension plan.

RRSP deduction limit

There are limits on how much of your contributions are tax-deductible and there is a penalty tax for contributions over these limits. Therefore, you should generally limit your contributions to these amounts.

The CRA calculates your contribution limit for the upcoming year. You can find your RRSP deduction limit by going to:

- Form T1028, Your RRSP Information for 2020 – CRA may send you a Form T1028 if there are any changes to your RRSP deduction limit since your last assessment.

- My CRA Account

- Tax Information Phone Service (TIPS)

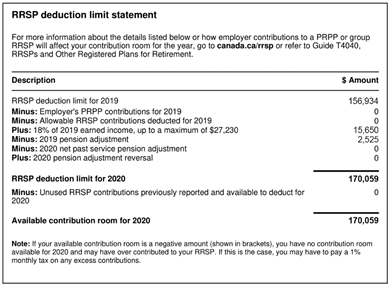

- the RRSP Deduction Limit Statement, on your latest Notice of Assessment

(Sample image of RRSP Deduction Limit Statement from CRA website)

Using the information from the sample statement, the individual had an RRSP deduction limit of $156,934, contributed and deducted $0 and generated an additional RRSP deduction room of $15,650 from their earned income, less the 2019 PA of $2,525. Therefore, for 2020, the individual has an RRSP deduction limit room of $170,059.

Please note CRA allows a $2,000 cumulative over-contribution grace amount with no penalty fee. You have to pay a tax of 1 percent per month on your contributions that exceed your RRSP deduction limit by more than $2,000 grace amount.

Making withdrawals from your RRSP

It depends on your situation when and how you should start to withdraw money from your RRSP. Generally speaking, you can withdraw money from your RRSP at any time. However, in order to take full advantage of the tax deferrals offered by an RRSP, you should wait until the end of the year in which you turn 71.

There are three options for your RRSP funds,

- Withdraw them,

- Transfer your RRSP funds to a registered retirement income fund (RRIF),

- Use your RRSP funds to purchase an annuity.

Note that when you withdraw funds from your RRSPs, your RRSP issuer will withhold tax. However, they will not withhold tax on amounts that are transferred directly to a RRIF or if the proceeds are used to purchase an annuity.

If you wish to understand more about Registered Retirement Savings Plan (RRSP) or get professional help preparing financially for retirement, contact an NPW Wealth Advisor today by calling 1-855-545-9090.